Efficiency in KYC Processing

Project Overview

The Result

Time Efficiency Gains: KYC processing time reduced by approximately 75%, achieving sub-10-minute throughput per applicant

Streamlined Alerts: Focused broker attention only on non-compliant or flagged cases

Improved Audit Readiness: Structured storage and standardized documentation reduced audit preparation time

Platform Scalability: The infrastructure supports future extensibility toward CRM capabilities and automated outbound communication

"The KYC automation is impressive, being able to preview results before generating a report and instantly access the file saves significant time. Using date of birth for matching helped me avoid reviewing irrelevant results, making the process faster and more accurate." — Client Feedback

The Challenge

Input applicant data manually into static systems

Perform risk assessment calculations without automation support

Conduct individual queries on global sanctions databases

Collect, annotate, and archive screenshots as audit trail artifacts

The cumulative time expenditure per applicant approached 30 minutes, introducing significant process latency, variability in documentation standards, and a non-negligible risk of human error.

The client’s KYC protocol, essential to meeting regulatory and due diligence requirements, relied heavily on manual processes, resulting in prolonged processing times, increased labor costs, and limited scalability.

"Streamlining redundant activities and ensuring data integrity within regulatory frameworks were essential to improving operational throughput."

— Project Analysis

The Solution

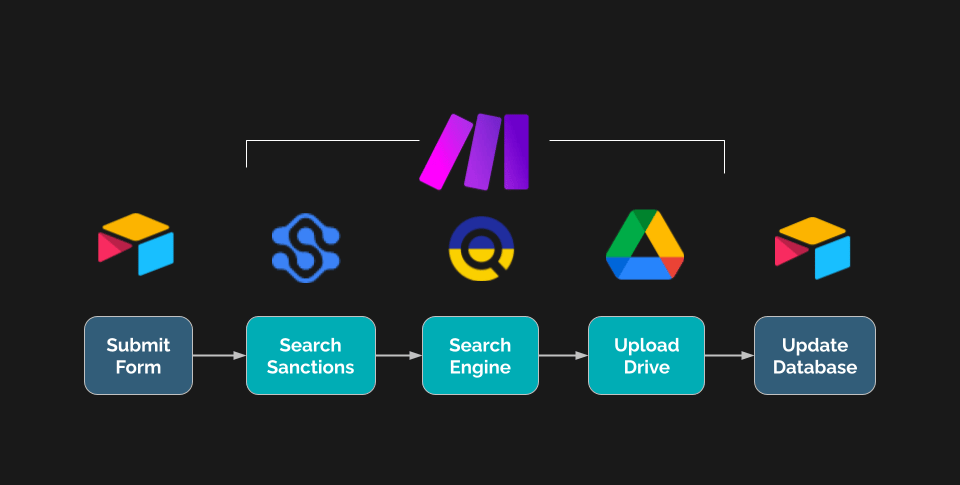

Technical Architecture:

Airtable – Configured as a relational data model and dynamic input interface

Make.com – Orchestrated all cross-platform integrations and process logic

Google Drive – Served as a structured storagefor generated compliance reports

DataForSEO SERP API – Enabled automated extraction and archival of search engine data for reputational due diligence

OpenSanctions API – Facilitated real-time sanctions screening across multiple jurisdictional datasets

The cumulative time expenditure per applicant approached 30 minutes, introducing significant process latency, variability in documentation standards, and a non-negligible risk of human error.

A modular, automated solution was designed using low-code platforms and publicly accessible APIs, offering a more agile and customizable alternative to traditional off-the-shelf KYC tools. Unlike standardized solutions, this implementation allowed seamless integration with the client's existing workflows, minimized unnecessary features, and provided full control over data handling and process transparency, all while maintaining regulatory compliance.

Operational Flow

Brokers initiate the process by submitting applicant data through a streamlined Airtable form, requiring only 4–7 minutes of input.

Upon submission, Make.com triggers automated workflows to:

Check global sanctions lists via OpenSanctions using the applicant's name and date of birth.

DataForSEO for capturing relevant search results and screenshots.

The collected data is automatically compiled into a professionally formatted PDF report and stored in a dedicated Google Drive folder.

The Airtable system is then updated with:

The sanctions check result (match or no match),

A calculated risk score based on predefined criteria,

Links to the captured screenshots for audit purposes.